Multifamily Pricing & Revenue Management

Strategies for Maximizing Profits

Table of Contents

Introduction

In the dynamic world of multifamily property management, pricing and revenue management play pivotal roles in ensuring the profitability and sustainability of your investments. Whether you are a seasoned property manager or just starting, understanding the intricacies of pricing and revenue strategies can help you navigate market challenges, maximize your income, and provide superior value to your tenants. This comprehensive guide delves into the essential elements of multifamily pricing and revenue management, offering practical insights and proven strategies to elevate your property management game.

SECTION 1 Understanding Multifamily Pricing & Revenue Management

Simply put, revenue management helps companies sell the right product to the right person at the right time for the right price.

Multifamily pricing and revenue management involves the dynamic setting and adjusting of rental rates to achieve a property’s or portfolio’s strategic business objectives. These objectives vary across businesses and even within them as different markets and different stakeholders will drive different strategies. Deciding which strategy is appropriate requires a keen understanding of ownership goals, market conditions, resident behavior and competitive positioning. One property or set of properties may benefit most from maximizing the next year’s rental revenue (i.e. balancing rent increases with maintaining or growing occupancy) while another may benefit from pushing the rent roll to prepare for a sale; yet another may forego maximizing rents in order to minimize both vacancy loss and the cost of turning units. Whatever an individual property’s or portfolio’s business objective, effective pricing strategies significantly enhance financial performance, ensuring a great return on investment.

SECTION 2 Key Factors Influencing Pricing & Revenue in Multifamily Properties

- Demand and Supply Dynamics: The balance between available rental units and prospective residents influences rental rates. High demand and low supply typically drive prices up, while an oversupply compared to demand may necessitate price to attract additional residents. Getting that balance right is notoriously difficult and thus a good reason to use mathematical pricing algorithms to complement your own local knowledge

- Market Trends and Competition: Monitoring local and regional market trends through regular attention to publicly-available competitive data (e.g. internet listings) helps you stay competitive. Understanding what similar properties offer can guide your pricing strategy to ensure you remain attractive to potential renters. In some situations, you will likely want to ignore what your competitors are doing while in others, you will want to be sure that you are not losing market share to them

- Property Location and Amenities: It’s obvious that prime locations and desirable amenities command higher rents. Proximity to schools, public transportation, and employment hubs, along with features like gyms, pools, and modern appliances, can significantly impact pricing. What’s much less obvious is how to convert that knowledge into actual, tactical pricing decisions. The good news is that your own internal demand (leads, visits, leasing) and supply (availability, notices, early terminations) data can tell you what you need to know—if you have a good pricing algorithm to interpret those market signals and convert them into price recommendations

- Economic Factors Affecting Renter Behavior: Economic conditions, including employment rates, inflation, and disposable income, influence renters' ability to pay and their rental preferences. As with location and amenities the challenge is converting these factors into actual ; price settings is not easy; and as with location and amenities, a good pricing algorithm can interpret the resulting demand and supply signals effectively

SECTION 3 Best Practices for Multifamily Pricing & Revenue Management

- Understand your pricing strategy. Are you trying to maximize upcoming rental revenue? Get the highest valuation? Protect occupancy for an upcoming economic downturn? Trying to hit a specific lease-up or renovation goal? Different business objectives call for different strategies, and a good revenue management system allows you to set multiple parameters to fit your strategy rather than forcing your strategy to fit the system’s algorithm.

- Utilize a formal demand and supply forecast. Pricing apartments is a lot more than just an appraisal exercise. It’s about controlling demand through inflections of price in order to get the most out of whatever inventory you have. In the immortal words of Wayne Gretzky, that’s about “going where the puck will be, not where it is.” And that requires formal forecasting of demand and supply.

- Understand rent and demand seasonality. Apartment demand can vary dramatically from high to low season, especially in more northern markets. Understanding this allows you to implement a Lease Expiration Management plan to ensure that you don’t have too much availability in the low season and that you can leverage the high season effectively.

- Conduct Market Research and Analysis. Regularly analyze publicly-available market data to understand trends, competitor pricing, and resident demographics. This helps you set competitive and attractive rental rates.

- Set Optimal Rental Rates. Use data-driven insights from your forecasts and your understanding of the market to establish rental rates that reflect your strategy.

- Implement Dynamic Pricing Strategies. Make changes to your rental rates on a daily basis. This form of dynamic pricing adjusts rental rates on a continual basis thus reacting in near-real-time to changing market demand and supply cues.

- Leverage Technology for Data-Driven Decision-Making. Utilize advanced software and analytics tools to gather and interpret data,marry it with your strategy and make appropriate price recommendations. These tools enable precise pricing adjustments and thus revenue optimization.

SECTION 4 Common Challenges and How to Overcome Them

- Balancing Occupancy Rates with Rental Income: Finding the optimal balance between occupancy and rental rates can be challenging, a challenge made even more complex when considering that different markets, and sometimes different properties within a market, may have different business objectives. An automated pricing system ensures regular updates, and weekly or bi-weekly reviews ensures that results are matching the desired outcomes.

- Dealing with Seasonality and Market Fluctuations: Separating seasonal trends from market fluctuations can be challenging. For example, a cyclical decline in demand could be hard to detect in the first half of the year when demand is rising seasonally. Separating these sometimes competing effects requires sophisticated mathematical algorithms.

- Handling Resident Turnover and Lease Renewals: Renewals often account for half (or more) of a rent roll. Automated pricing systems help owners ensure that their strategies are implemented across all expiring leases enhancing results and guaranteeing compliance with Fair Housing.

- Addressing Regulatory and Legal Considerations: The increasing quantity and complexity of rent control scenarios makes it increasingly difficult to be sure that new and renewal rent offers are compliant. Rather than relying on individual knowledge and/or manual processes, we can “build the genius into the system” and use these purpose-built pricing systems to implement all pricing and process rules.

SECTION 5 What Makes a Great Contemporary PRM Tech Solution

Intelligent Pricing Inputs and Forward-Looking Metrics

Contemporary PRM systems should use forward-looking metrics such as availability rather than backward-looking ones like occupancy. Availability provides a better metric for pricing decisions as it reflects current market conditions more accurately. Additionally, incorporating leasing velocity – the pace of leasing – helps in making more informed pricing decisions.

These systems should also allow for flexibility in using competitor data. Users should have the option to include or exclude comp data based on its accuracy and relevance to their strategy.

Enhanced Workflows and Reduced Total Cost of Ownership (TCO)

A great contemporary PRM solution should streamline workflows to reduce the TCO. Improved user interfaces and alert-driven workflows can save time and allow revenue managers to handle more communities, thus enhancing productivity. For example, waking up in the morning and immediately seeing where to focus attention eliminates wasted time searching for issues and dramatically increases efficiency.

Reducing the number of clicks required to get the necessary data is another critical improvement. A well-designed user interface, built with the insights from two decades of experience, can significantly reduce the effort needed to interact with the system.

Flexibility and Customization

A modern PRM system must be flexible and customizable to fit various business strategies. It should provide comprehensive reporting at different levels – from unit to portfolio – and integrate seamlessly with analytics platforms. This flexibility enables revenue managers to configure the software to their specific needs and respond quickly to market changes.

Handling rent control and constraints efficiently is another crucial feature. A good PRM system should provide start and end dates for constraints, allow for rules-based caps, and consider process rules such as notice periods for significant rent increases.

It should also handle the many “special cases” pricing situations—renovations, lease-ups, small count unit types and concessions strategies.

SECTION 6 Navigating the Current PRM Litigious Environment

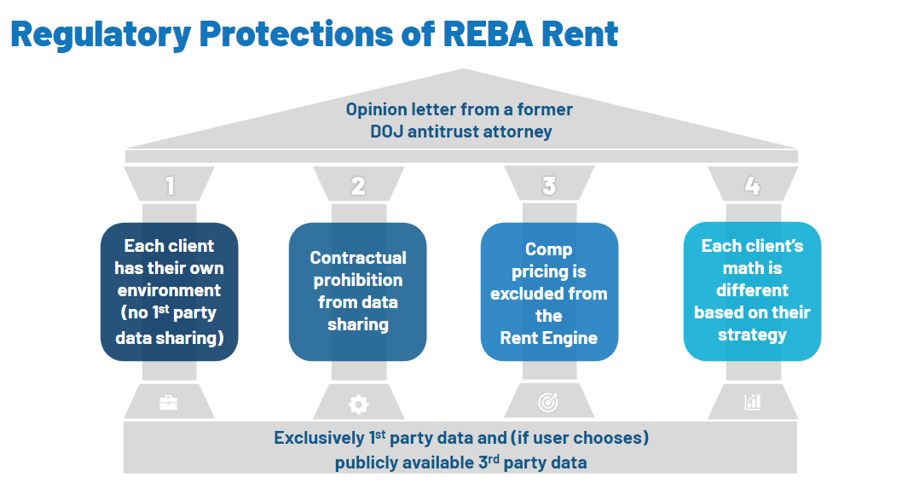

The pillars of "safe" algorithmic pricing.

It’s not really possible to talk about pricing in the rental housing industry without addressing anti-trust and price collusion concerns.

A shown in the figure above, the keys to staying out of the line of fire are

- Ensuring no use of non-public competitive data in any form

- Using competitive data for context and not for pricing recommendation calculations

- Ensuring users of the system control how their algorithm works through their own parameter and configuration settings

And, of course, users have the ability to override any recommendations as they see fit.

SECTION 7 Our Stance on Comp Data

A robust rental housing pricing and revenue management (PRM) system should not depend on competitive data to operate effectively. Here’s why:

The Challenges of Comp Data

Accuracy Issues

Obtaining accurate comp data is notoriously difficult. Websites often provide inaccurate information, and call-arounds typically reflect what competitors want to disclose, not necessarily the real prices. While secret shopping can yield more accurate data, it is time-consuming (and thus not scalable) and often fails to capture special concessions made during economic downturns.Risk of Collusion Claims

The processes used to acquire comp data can expose operators to claims of collusion or price fixing. Even an exchange of public information is fraught with legal risks. For example, a community manager or leasing associate reacting with surprise to a stated asking rent could be construed as giving a “cue” for changing that rent even if that’s not what they intended to communicate.Questionable Relevance

Relying on competitors’ data for pricing decisions is not ideal. Competitors may have different objectives, strategies, or levels of competence. Experience in multifamily housing pricing shows that all necessary data to gauge pricing effectiveness is available internally. Key indicators such as leasing rates, availability and lead pipeline provide ample data to accurately determine whether current prices are too high. too low or just right.

An effective PRM system prioritize forward-looking metrics like availability and incorporate leasing velocity to make informed pricing decisions. By focusing on internal data and real-time market conditions, such systems can ensure optimal performance and compliance with evolving legal standards.

"As well as they have performed, legacy PRM systems lack the full range of capabilities needed to better balance process and pricing psychology with math."

Donald Davidoff

CEO & Co-Founder

Conclusion

Mastering multifamily pricing and revenue management is essential for maximizing profits and ensuring the long-term success of your property investments. By implementing the strategies and best practices outlined here, you can navigate market challenges, optimize your rental income and provide exceptional value to your tenants. Remember, continuous learning and adaptation are key to staying competitive in the ever-evolving multifamily industry.

Download our PRM White Paper

Modern pricing & revenue management solutions for modern pricing and revenue managers.

SHARE